Commercial Lending Process Explained

Many business owners approach their banks and the commercial loan process assuming things will be similar to their experiences securing a personal loan for a home or a car. However, that is most often not the case and can cause confusion and lost time.

The commercial lending process differs from most consumer lending, such as residential mortgage lending, in that there are no hard rules or ratios that make a loan either acceptable or unacceptable.

The commercial loan process is a bit more of an art than a science. However, the underwriting process of sound commercial lending is not the mystery it may seem to be. It is simply a process of information gathering (or due diligence), financial analysis, and informed decision-making.

The process described in this article is typical for a new client; an existing client with an established history would most likely encounter a more streamlined process. While the process outlined here may seem rigorous, remember there are many components to consider in the decision-making process and every business has its own unique story that needs to be understood.

All of these factors, coupled with the fact that banks are highly regulated and are lending depositors’ and shareholders’ money, makes it clear that there is little room for wrong loan decisions. That is why there are typically several potential sources of repayment for a commercial loan — cash flow, collateral, and guarantors. To analyze these repayment sources, the bank must first get to know and understand the prospective borrower. The areas of focus include:

- Meeting With Company Management

- Background of Your Company's Industry

- Company Credit Needs (Current and Proposed)

- Company History

- Company Financials

Details of the bank’s commercial credit analysis on the five items above lead to loan decisions, so it is important for business owners to know how to clearly and concisely represent themselves in the process.

Meeting With Company Management

The bank’s due diligence process begins by meeting with company management. General information about ownership, management, products and markets, finances, and brochures contribute to an understanding of the business. These provide important background information, and give the banker a perspective of management’s understanding of the business.

Financial Information Required In The Commercial Loan Process Includes:

- Year-end balance sheets and income statements for the past three years

- The most recent interim financials along with corresponding statements from the prior year and the annual budget

- Business tax returns (if year-end statements are unaudited)

- Accounts receivable aging and possibly accounts payable aging

- Personal financial statements and personal tax returns because the owner(s) typically personally guarantee the debt for most privately held businesses

The bank is trying to determine, "Does management understand the company's financial statements, competition, competitive advantages?"

Ideally, the banker has at least one meeting at the business location to provide a tour of the facilities. This allows the banker to observe the general working environment, equipment quality and upkeep, and inventory control and management. It also provides an insight into management’s understanding of the operations.

The management assessment includes not only the owners but also other key personnel. Relevant information includes individuals' names, areas of responsibility, tenure with the company, and prior experience. The goal is to get a solid determination of management’s experience level and depth. Some businesses rely heavily on a key individual, and this risk needs to be addressed, possibly with life insurance on the key person.

Who Should You Include In The Company Management Meeting?

A Background of Your Company's Industry

It’s important for your banker to understand your industry, as each industry has unique needs and challenges that are vital to take into consideration to create an accurate, comprehensive picture of your company, its health, and its future outlook.

Your Banker should understand the main needs and concerns in your industry so they have the ability to:

Your industry likely also has a unique jargon, so your banker should be fluent to allow for more effective, precise communication, resulting in a more efficient and successful relationship. Bankers, like those at First Business Bank, who integrate industry practice groups have a higher level of understanding in many different sectors, resulting in a team that understands your specific needs.

Your industry likely also has a unique jargon, so your banker should be fluent to allow for more effective, precise communication, resulting in a more efficient and successful relationship. Bankers, like those at First Business Bank, who integrate industry practice groups have a higher level of understanding in many different sectors, resulting in a team that understands your specific needs.

Bankers who specialize in your industry also help by:

- Building their knowledge of industry best practices, allowing them to help guide you with experience

- Developing a network within your industry to help you grow

- Using their knowledge of payment and sales cycles, equipment needs, and capital requirements within your industry to suggest specific future financing possibilities.

Bankers who have experience in your industry have an advantage in many ways. During the commercial lending process, a banker who isn’t knowledgeable about your industry will need to do additional research, such as investigating trends or changes affecting the industry and specific threats to prospective customers. The learning process might also include contacting your significant customers or vendors, and, as you can imagine, all of this takes time.

More significantly, if your banker has experience or understanding in your industry, it can translate to more good opportunities for your business.

Commercial Loan Analysis of Your Company's Credit Needs

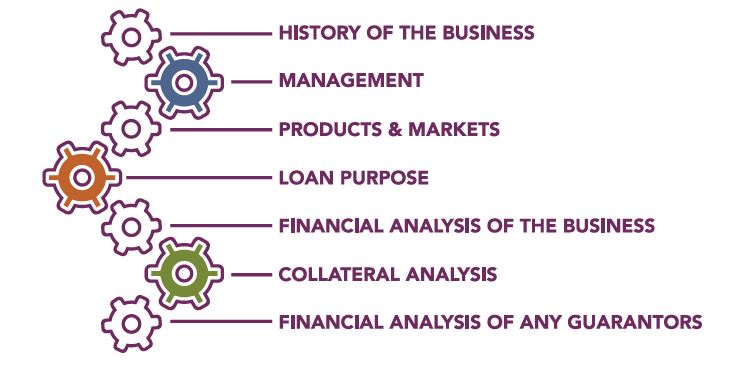

Bankers use information from outside credit sources, such as Dun & Bradstreet, for the business and credit bureau reports on guarantors to learn about any historical payment performance. Uniform Commercial Code searches help bankers determine if other creditors hold existing lien positions. The banker compiles the information and writes a commercial loan analysis, the goal of which is to reasonably assess the likelihood of continued future success for the company and its ability to repay the loan(s). Those who make the loan decisions review the analysis, and use it to document loan approval. The basic part of the written commercial loan analysis typically includes sections covering:

Review of Your Company History

The history of the business gives bankers an idea of the company’s evolution, historical success, and longevity. In addition, the type of ownership (sole proprietorship, S Corp., LLC, etc.) sheds light on what financial information needs to be examined and how the commercial loan should be structured.

A banker should understand your product and market well to determine:

- What exactly do you do? The analysis should articulate how you differentiate yourself from competitors. Is the company positioned as a low-cost provider or do you provide higher quality, better service, or faster turnaround?

- Who are the major competitors and what are barriers to entry for new competitors?

- Who are major customers and what industries are they in? Is there a major concentration risk to be analyzed?

- How are sales generated — by inside sales people, outside sales reps, or distributors?

- Are revenues cyclical with the general economy and/or seasonal? This should be considered when structuring loans and loan payment requirements. All of these types of questions need to be answered, thought through, and analyzed to identify areas of potential risk and how such risks can be mitigated.

For example, working capital needs triggered by growth should be funded by a line of credit with interest-only payments required, while an amortizing term loan better matches the life of longer-term assets such as equipment or real estate. A brief schedule of the sources and uses of the transaction may clarify the credit need.

Financial Statements Analysis

During the commercial loan process, banks use industry-specific spreadsheet software to analyze financial statements, looking at several periods for trends and significant changes as well as generating various financial ratios for analysis.

- You can calculate your ability to meet current obligations using the current ratio (current assets divided by current liabilities) or working capital (current assets minus current liabilities).

- Leverage is the company’s net worth position relative to its liabilities. This is calculated using a debt-to-worth ratio (total liabilities divided by net worth). An acceptable current ratio or debt-to-worth ratio depends on the industry and the life cycle of the company.

For example, is it a relatively young company, a recent acquisition, or a fast-growing business? Consequently, bankers look at these types of ratios for trends and measure them against industry-relevant data when making loan decisions. Similarly, they measure days outstanding of accounts receivable, inventory, and accounts payable versus industry norms and previous period levels. Large variances can indicate problems with collections, inventory controls and/or cash flow, which require further explanation.

While this analysis can be in depth, a few key pieces of data are fundamental. Major items on the balance sheet that are examined include:

Reviewing Your Financials

Your banker analyzes your company’s income statement to look at items beyond just sales and net income growth or compression. For example, they compare gross profit margins and operating expense levels to industry averages to look for trends.

Be prepared to explain changes in these items relative to your business strategies. Examples include:

- if sales are up but gross profit margin is down and sales expenses are up due to penetration into a new geographic market

- variable economic and market conditions, e.g. raw materials costs rose and it took time to work through pricing contracts already in place

Cash flow is the primary source of debt repayment and paramount to a banker during the commercial loan process.

Cash flow is different from earnings — non-cash items such as depreciation and amortization expenses from the income statement, balance sheet changes such as growing receivables and inventory levels, and other debt payments need to be factored in. The bank’s analysis calculates cash flow using both the income statement results and balance sheet changes. The lender analyzes historical, current, and projected ability to service the debt as well as capital expenditure needs and any other obligations that must be paid.

Collateral analysis is a basic part of any commercial loan analysis. It provides a secondary source of repayment in case expected future cash flow does not happen as planned.

The bank will look at the values of the company’s assets on which it has a lien, and apply a discounted value for collateral purposes. The bank would usually not lend beyond that amount unless there is a strong guarantor or other collateral. Beyond experience and industry standards for discount factors, appraisals for both real estate and equipment can help provide more information.

Beyond the guarantor's net worth, personal liquidity is key.

Finally, during the commercial loan process, bankers analyze the financial statements of any guarantors to determine additional strength they bring to the deal. Cash or marketable securities provide liquidity to cover temporary cash flow shortages, or can be a secondary source of repayment on unsecured or under-collateralized loans. They also analyze the guarantor’s personal cash flow, which goes beyond just personal income,factoring in other items such as required personal debt service.

Loan Decisions And Outcomes

Even for a strong company, there may be a question mark about the business’s longevity, management depth, competitive threats, a concentration with one customer, or issues on the financial statements. Decision-makers weigh the pluses and negatives to come up with a commercial loan decision. In the end, this is where the lender and the loan committee prove their worth and provide well structured, prudent commercial loans to their community.