When it comes to Small Business Administration (SBA) loans, we often encounter preconceived thoughts and myths that can create unfounded concerns among prospective borrowers. Critics of SBA Lending often express concerns about rumored extensive paperwork, cumbersome processes, and challenging rules and regulations. Here, we deconstruct some myths of SBA Lending and offer insights from an SBA loan expert at First Business Bank.

Explore this article with these helpful links

- What Challenges Do SBA Loans Overcome?

- How Long Do You Have To Pay Off SBA Loans?

- How Big Are SBA Loans?

- Which Industries Use SBA Loans?

- Who Is Eligible For SBA Loans?

- How Do Businesses Use SBA Loans?

- Where Do SBA Loans Work?

- What Does It Take To Apply For An SBA Loan?

- What Smooths The SBA Loan Process?

- Are There Any Other Benefits Of SBA Loans?

- SBA Loans Empower Business Success

Why Choose SBA Loans?

Collaborating with partner banks like First Business Bank, the SBA helps businesses access financing for growth, acquiring a business, expand, buy or replace equipment, refinance debt, and other uses in situations where typical financing won’t work for various reasons.

"Every time you say the letters S-B-A, everyone kind of gets concerned and some people even cringe,” said Jerry Huynh, Managing Director of SBA Lending for First Business Bank. “But the SBA, with their partner bank, offers loans that, at the conventional level, just wouldn't take place."

What Challenges Do SBA Loans Overcome?

SBA loans are appealing to borrowers who might face difficulties getting traditional bank loans due to challenges like not having enough collateral, a suboptimal credit score, or limited debt service coverage.

“It's not too often that you find a quintessential borrower who has everything lined up perfectly. Quite often there are things we need to help them overcome,” sad Huynh, who once worked at the U.S. Small Business Administration.

Collateral is a primary concern that’s a hurdle for many borrowers, and not having enough can be a deal-breaker for a conventional loan, but the SBA offers flexibility.

“Sometimes there just isn't sufficient collateral to cover the loan amount that's being requested,” Huynh said. “The SBA’s guidelines allow lenders to lean on the cash flow of the borrower as the primary source of repayment, not on how much collateral is offered.”

Businesses also often have difficulty demonstrating consistent debt service coverage — income required to cover the loan debt.

Another advantage is that the SBA entertains future projections, which allow you to show how the loan will help you achieve your goals.

How Long Do You Have To Pay Off SBA Loans?

Amortization, which refers to the period over which loan repayments are scheduled, varies by loan. SBA loans offer the advantage of extended amortization, allowing more time and flexibility to pay back SBA loans than traditional commercial loans.

In practical terms, this might mean that a manufacturer with existing debts, looking to transition from leasing to owning a commercial space, can benefit significantly. Under SBA guidelines, this company could make a down payment of as little as zero to 10% down for an SBA loan to buy commercial real estate compared to the 25-30% typically required for a conventional loan.

“Many business owners benefit from the SBA program due to the extended amortization that can provide an affordable monthly payment,” Huynh said. “The monthly savings help preserve capital for a business continued growth.”

How Big Are SBA Loans?

When considering an SBA loan, the size of the deal is vital. SBA loans are versatile, catering to a wide range of business projects. Some banks offer microloans as small as $10,000 to $50,000, creating a spectrum of opportunities for business needs.

However, First Business Bank prefers to start with loans around $200,000, extending up to the typical range of $5 million under the SBA 7(a) program. In specific scenarios involving commercial real estate and heavy equipment, known as 504 loans, the loan amount can even exceed $5 million depending on the structure of mortgages and deal composition.

Which Industries Use SBA Loans?

While SBA loans might not be a fit for every business lending need, partner banks often have industry preferences, with some focusing on specific industries or use cases, like acquiring commercial real estate.

"Some banks may prefer to do hotels, some banks may prefer to handle healthcare clinics, urgent care facilities, or veterinarian clinics," Huynh said.

However, the general consensus is that no entrepreneur should consider themselves unsuitable for an SBA loan. A well-rounded SBA lender can offer advice and direction, ensuring that various for-profit businesses can find an appropriate fit.

"I don't think any entrepreneur should consider themselves unworthy,” he said. “An experienced and seasoned SBA lender can advise the borrower and guide them in the right direction.”

Who Is Eligible For SBA Loans?

Business leaders often rule themselves out from applying for SBA loans because they believe that either they are performing too well or struggling a lot makes their businesses ineligible for SBA loans.

"If you have a business that's doing great, you may think you're overqualified for an SBA loan,” Huynh said. “Or on the other side, if your business isn't doing well, you might think you don't qualify for any loan, let alone an SBA loan."

"If you have a business that's doing great, you may think you're overqualified for an SBA loan,” Huynh said. “Or on the other side, if your business isn't doing well, you might think you don't qualify for any loan, let alone an SBA loan."

The key to navigating this is seeking the counsel of knowledgeable SBA experts who can offer accurate advice and evaluations.

"Let's not ever get into a situation where you think you don't qualify for something,” he said. “Try to find that SBA lender or professional who knows what they're talking about, evaluates your balance sheet and financials then says, ‘You know what? I think we may have a solution.'"

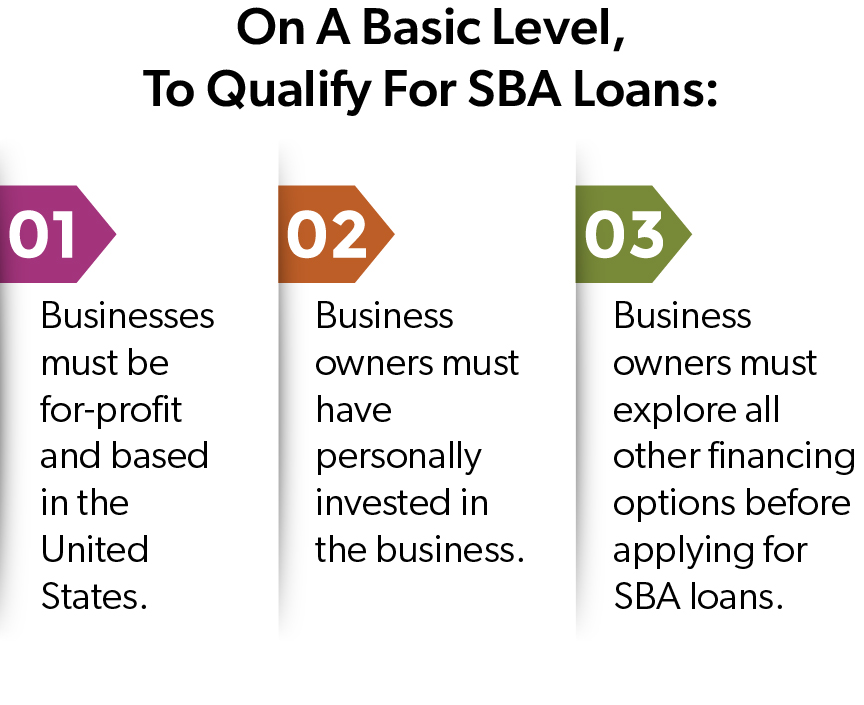

On a basic level, to qualify for SBA loans:

- Businesses must be for-profit and based in the United States.

- Business owners must have personally invested in the business.

- Business owners must explore all other financing options before applying for SBA loans.

How Do Businesses Use SBA Loans?

SBA loans are versatile, adapting to the needs and visions of different businesses. They can play a crucial role in ownership transitions, allowing for smooth transitions and ensuring the continued success of the business. Another common application is in debt refinance coupled with real estate acquisitions, enabling businesses to consolidate their debts while expanding their operational capacities.

The practical impact of SBA loans is beautifully illustrated by the story of a family-owned printing company looking to pass down the business. A seamless transition, facilitated by an SBA loan, allowed the family to overcome various hurdles and resulted in a $4.2 million SBA 7(a) loan that allowed the parents to retire comfortably and the son to assume control of the company.

"There were some collateral shortfalls and items we needed to overcome, and the process took a few months,” Huynh said. “But at the end of the day, 28 employees and families that worked for that small printing company kept their jobs and continue to move forward to this day."

Where Do SBA Loans Work?

Working with partner banks, the SBA makes loans across the United States and even to territories like Puerto Rico and the Virgin Islands. This flexibility enables businesses to explore and tap into diverse markets, fostering growth and development.

“The great thing about working with the SBA is that we can facilitate a loan anywhere in the continental United States and even territories,” Huynh said.

What Does It Take To Apply For An SBA Loan?

The SBA loan application process is plagued by myths about mountains of paperwork. However, like securing a mortgage, the SBA loan application requires the borrower to provide specific documents and respond to timely requests.

“We take extra care to communicate up front with borrowers about what to expect during the SBA loan application process,” Huynh said. “We explain exactly what's going on with the specific forms, and what we need to do to get everything done.”

Securing an SBA loan requires attention to detail and providing accurate financial and personal information, tax returns, and other documents. It’s important to know in advance that applying for an SBA loan takes time away from your primary responsibilities of running a business.

“We see the most success when the applicant or borrower is engaged in the process,” Huynh said. “But it does take time, and it takes concentration to make it a successful process."

What Smooths The SBA Loan Process?

Effective communication and collaboration with various professionals involved, such as CPAs and architects, are essential in the SBA loan process. Having professionals who can communicate seamlessly with one another, understand the language of the trade, and work cohesively can expedite the process.

“We need to be able to communicate with their professionals,” Huynh said. “I’ve been fortunate to have worked for the Small Business Administration for several years, so whenever I speak to a CPA or an attorney, being able to address the nuances of SBA policies with them allows us to be on the same page.”

Are There Any Other Benefits of SBA Loans?

SBA loans bring with them hidden advantages, especially during economic booms, as they come with a government guarantee, providing lending banks with a sense of security.

"Because there's a government guarantee that goes with the loan, the lending bank has a greater certainty of collectability on the vast majority of the loan," Huynh said.

In times of economic strain, the SBA often introduces enhancements to the program, including higher guarantee rates, reduced fees, and occasionally covering payments for specific periods. These extraordinary measures prove invaluable during economic crises like the COVID-19 pandemic and the Great Recession, offering unanticipated relief to borrowers.

SBA Loans Empower Business Success

Although sometimes misunderstood, SBA loans provide crucial funding for businesses when conventional lending avenues might be closed. By understanding and leveraging the opportunities SBA loans offer, businesses can achieve growth and find stability.

SBA loans are an important lending option for various businesses, serving many industries and geographies. Their flexibility, extensive reach, and custom solutions make them an invaluable resource for business growth. By dispelling the myths and understanding their potential, businesses can leverage SBA loans to fuel their growth and navigate their journey to success.