While high-tech fraud makes splashy headlines, good old-fashioned check fraud is still the number one fraud threat, according to the Association for Financial Professionals’ (AFP) Payments Fraud Survey. In the latest survey, 74% of respondents, which include nearly 700 bank treasury and finance professionals, report organizations experiencing check fraud. These check fraud true story examples highlight the latest solutions that can help your business prevent this pervasive fraud.

Check Fraud Example Resulted in $49,000 Loss

A fraudulent check cleared a business checking account two weeks prior. The check amount and serial check number matched a legitimate check they’d paid, however, while reviewing the check image they noted the payee on the check was altered to be payable to a person, not the business they’d paid. The payment discrepancy became apparent when their vendor alerted them of their past-due invoice. Everything except the payable information matched the original, so the fraud wasn’t detected in their visual review of checks clearing their account. The Federal Reserve requires that checks that are fraudulent, insufficient funds, uncollected, or for any other reason be returned by midnight of the following business day. Since the regulatory deadline for returning fraudulent checks had passed, we were no longer able to return the check. Deposit and treasury management agreements state the client assumes liability resulting from losses or damages if they haven’t subscribed to First Business Bank’s security services. Meanwhile, the business worked with law enforcement in its locality as well as the jurisdiction of the financial institution where the check was deposited, who spent countless hours investigating the fraud. Ultimately, the client lost $49,000, which could have been prevented by security solutions and check fraud protection best practices.

A fraudulent check cleared a business checking account two weeks prior. The check amount and serial check number matched a legitimate check they’d paid, however, while reviewing the check image they noted the payee on the check was altered to be payable to a person, not the business they’d paid. The payment discrepancy became apparent when their vendor alerted them of their past-due invoice. Everything except the payable information matched the original, so the fraud wasn’t detected in their visual review of checks clearing their account. The Federal Reserve requires that checks that are fraudulent, insufficient funds, uncollected, or for any other reason be returned by midnight of the following business day. Since the regulatory deadline for returning fraudulent checks had passed, we were no longer able to return the check. Deposit and treasury management agreements state the client assumes liability resulting from losses or damages if they haven’t subscribed to First Business Bank’s security services. Meanwhile, the business worked with law enforcement in its locality as well as the jurisdiction of the financial institution where the check was deposited, who spent countless hours investigating the fraud. Ultimately, the client lost $49,000, which could have been prevented by security solutions and check fraud protection best practices.

Check Fraud Protection and Prevention Solution:

Payee Positive Pay, a check fraud solution, would have immediately detected the altered payee and the check would have been returned timely to the Federal Reserve with no loss of time or money. With Payee Positive Pay, you electronically submit your check register to us, and when the checks are deposited and they match, they will be paid automatically. If they don’t match, you’ll receive an alert to decide whether to pay or return the check. Learn more about fraud prevention solutions.

Check Fraud Example of Testing The Waters

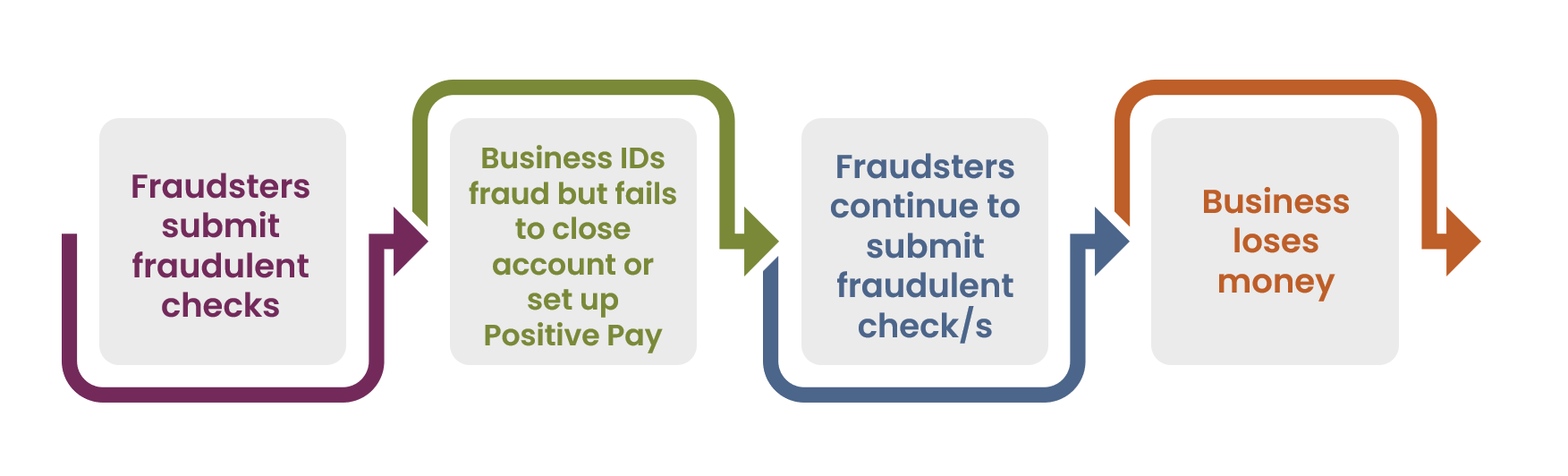

Three counterfeit checks were presented against an account. They notified us after the Federal Reserve’s check return deadline, so we were unable to return the checks and the client took the loss. We advised them to close their account or set up Payee Positive Pay. Then, in two months later, two fraudulent checks came through – one on December 24 and the other on December 31, which totaled $799.97. The client hadn’t closed their account nor implemented check fraud protection and prevention, and we were unable to return the checks. Unfortunately, the client mistakenly thought that requiring two signers on the check would protect them from further fraud, but this internal employee fraud control measure doesn’t guarantee check fraud protection.

This type of pattern is common — fraudsters “test” the account by passing fraudulent checks, and if that’s successful, they’ll wait to give victims a false sense of security that the fraud is finished. After a few months (or even years), they begin writing checks against the account again.

This type of pattern is common — fraudsters “test” the account by passing fraudulent checks, and if that’s successful, they’ll wait to give victims a false sense of security that the fraud is finished. After a few months (or even years), they begin writing checks against the account again.

Check Fraud Protection and Prevention Outcome: The client closed the account, and opened a new account with Payee Positive Pay to ensure they are protected against check fraud.

Check Cashing Fraud

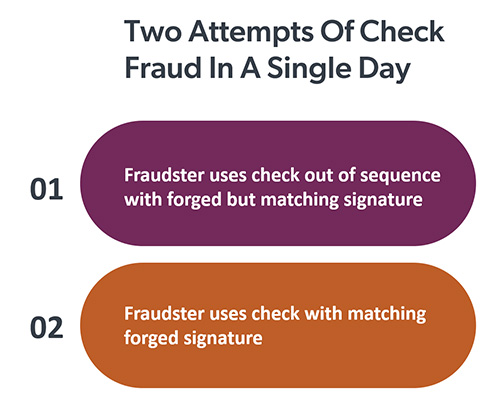

Two non-client individuals went into First Business Bank’s Madison office about two minutes apart to cash checks drawn on accounts of two separate clients. The individuals went to different Client Service Associates. One asked to cash a check drawn from the account of a client of our Northeastern Wisconsin office and so the Client Service Associate didn’t know him. When she performed an account inquiry, she noted the check number was out of sequence, the signatures didn’t match, and the check stock was different. When she told the check casher that she would call our client to verify the check, the individual took the check back and exited the branch. The next person presented a $1,500 check drawn on an account of a Madison client. The check serial number, check stock, and drawee signature matched – but it was a forgery. Since all the data matched, the check was cashed, however, it was fraudulent. The local police department was contacted and an incident report was filed. We don’t know how these individuals obtained the bank clients’ account numbers, and, in the one case, valid serial number, and signature. However, checks are often stolen out of mailboxes or en route to the post office.

Two non-client individuals went into First Business Bank’s Madison office about two minutes apart to cash checks drawn on accounts of two separate clients. The individuals went to different Client Service Associates. One asked to cash a check drawn from the account of a client of our Northeastern Wisconsin office and so the Client Service Associate didn’t know him. When she performed an account inquiry, she noted the check number was out of sequence, the signatures didn’t match, and the check stock was different. When she told the check casher that she would call our client to verify the check, the individual took the check back and exited the branch. The next person presented a $1,500 check drawn on an account of a Madison client. The check serial number, check stock, and drawee signature matched – but it was a forgery. Since all the data matched, the check was cashed, however, it was fraudulent. The local police department was contacted and an incident report was filed. We don’t know how these individuals obtained the bank clients’ account numbers, and, in the one case, valid serial number, and signature. However, checks are often stolen out of mailboxes or en route to the post office.

Check Fraud Protection and Prevention Solution: To avoid check fraud, pay vendors with ACH payments, implement bill pay via our Online Banking applications, enable electronic statements and loan notices, review account activity (including check images) daily, and implement ACH and Payee Positive Pay services.

First Business Bank takes extra precautions to try to protect clients from cash-cashing fraud:

- If we don’t know the person cashing the check, clients may receive a call to confirm the validity of the check.

- If we are unable to reach a client, we may call the account officer to provide updated contact information or help make input into the decision-making process.

Check Fraud Example of Urgent Impersonation

A fraudulent business email (business email compromise) was sent to an employee at a different business requesting payment of an invoice for $24,500, which was purported to be “extremely” past due. The fraudulent email, which was marked urgent, looked like it came from the owner of the vendor company. The employee paid the invoice, but the owner recognized the fraud when the check cleared their account. He reported it to First Business Bank past the noon deadline, but fortunately, because it was a federal holiday, the bank was able to return the check in accordance with regulatory requirements. The client otherwise would have taken the $24,500 loss not to mention loss of employee time and resources of law enforcement and bank staff.

No one is immune from check fraud, but First Business Bank’s check fraud protection solutions can greatly reduce the risk of check fraud and other losses. Working in conjunction with each other, these solutions provide more security for your business. Other solutions that help manage fraud losses include, but are not limited to:

- Online Banking internal daily review of transactions clearing deposit accounts (remember to validate the payee of each check image since often the payee is the only item that is altered)

- Internal dual control for issuing checks and reconciling accounts

- Tokens for authorizing transactions such as ACH and wires

- Dual control for ACH and wire transactions, validating back to the source document

- Electronic statements

- Paying vendors via ACH rather than paper checks

- SecurLOCKTM Equip app for debit card transactions

- ACH Positive Pay

- Payee Positive Pay

- Account Reconciliation

Check Washing Fraud Case Study

A client emailed First Business Bank to report a check washing fraud. Check washing is a process, often involving chemicals, to first erase and then change the payable information on a check, such as the payee and dollar amount. In this case, altered payee information on a check previously written for $32,900.000 cleared the client’s bank account.

Per First Business Bank and Uniform Commercial Code requirements, the client completed an Affidavit of Check Fraud and provided proof of original payment. With those documents, First Business Bank submitted a claim to the financial institution that accepted the altered check from the fraudster and was able to recover the funds for the client.

To prevent loss due to check washing fraud, First Business Bank recommends clients add Payee Positive Pay to their accounts. With this solution, clients electronically upload check files for all issued First Business Bank checks. Checks presented against clients’ accounts each night are compared to clients’ issued check files. Then, they receive alerts for any checks that don’t match the issued check file — in payee, dollar amount, or check number. This real-time check fraud monitoring system allows clients to access check issue exceptions and make online decisions by a predetermined time. This allows First Business Bank to return fraudulent checks and clients incur no monetary loss.